Reason for engaging in any form of trade is to earn profits from the goods or services you trade in. Profit law applies across all trade platforms which includes stock trading. Everyone wants to gain from the stock market. However, for you to trade like a pro and earn from your effort, you need to have a clear strategy that you will depend on while trading. Here are 5 top strategies commonly used in the stock markets across the globe:

- Breakouts

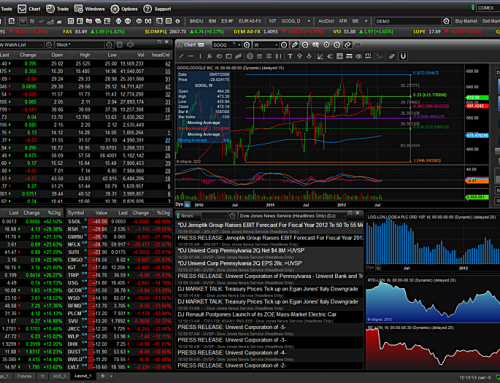

Breakouts are among the most commonly used strategies by stock traders. The method involves a trader identifying key price level which is followed by either selling or buying as the stock price breaks a pre-determined level. Expectation here is for the price to have strong force enough to pre-determined level and continue rising following the same direction.

With the expectation of the prices moving higher or lower until they break the pre-set prices in mind, all you need to do is set an order slightly high above the pre-set price or slightly below a low set price. These limit orders, as they are known in the stock market, ensure that you get a trade automatically whenever the prices rise or fall to the level of order you had set.

- Retracements

Retracements are slightly different from breakouts and require a trader to have a slightly different set of skills. Here, a stock trader is supposed to identify the exact direction in which the price will move and be confident that the price will not change direction.

The strategy is based on the concept that the price is expected to reverse after every profitable move made by pro traders as novices struggle to trade in the wrong directions. Replacements or “pull backs” as they are known give professional stock traders better prices which they use to enter an original direction before a move continuation.

You have to implement fundamental analysis when using this kind of trading. The system is very much similar to the breakout strategy in many ways.

- Reversals

Reversals are a favourite for technical based traders when little fundamental action is taking place. During such times, the markets are normally unpredictable, swaying in every direction. Stock traders look out for price levels that they can depend on trading while hoping for a “bounce” to occur. When it finally occurs, quick, but small opportunities present themselves for the traders to reap profits.

As the first two strategies, tools used here are he same.

- Momentum

Unlike the other 3 strategies, this strategy concentrates more on the continuity of a move rather that a “precise direction” of a move. Here, traders are not on the watch for the prices to breakout or pullback, but instead moving further in the direction the price is trending.

- Position trading

Position trading does not depend on the entry of a trade although it utilizes the momentum strategy. A stock trader is required to be present in the market place when price starts moving in a specific trend. A main component position trading strategy is the dependence of the fundamental conditions that prevail themselves which drive the price higher or lower.