Who are Stock Traders?

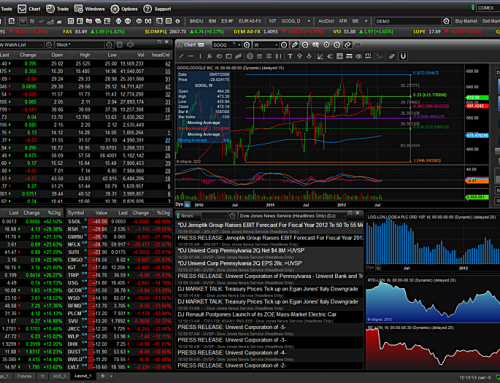

Stock traders can be described as self-employed workers. Their focus lies on the share market. Stock traders use brokerage firms or banks as an intermediary to trade stocks on the share market. They generate income from the shares in which they invest. Stock trading is quite a simple task paper. Stock traders buy the share from the market for a certain price. Once the share increases in value, they sell the share at a higher price, and hence make a profit out of it.

Risks of Stock Trading

Stock trading isn’t as easy and uncomplicated as it sounds from its definition. The share market has a very unpredictable nature. Hence there are various risks and uncertainly involved in the stock business. The high level of risk surrounding stock trading compels people to think twice about this business. In addition to that, stock traders are required to pay hefty sums of money as brokerage fees to the bank of brokerage firms. It goes without saying that stock trading is not for the faint hearted.

Effective Strategies of Stock Trading

Despite the volatile nature of the business, stock trading can lead to monumental financial success. Stock traders employ a number of strategies to tackle the complexities of stock trading and maximize profits. Below is a list of 4 such strategies.

1) Day Trading

In this form of stock trading, stocks are bought and sold within a 24 hour period so that by the end of that timeframe, the stock trader does not have any stock in hand. Day time stock traders sell a share whenever another share of equivalent value is purchased. The profit and loss is determined by the difference between the sale price and the buying price of the share. As mentioned before, the stock market is quite a turbulent place where prices can go up and down in a matter of seconds. Hence, stock traders resort to day time trading to avoid incurring any losses as a result of drastic overnight changes in the stock market.

2) Swing Trading

Swing trading involves holding on to stocks from anywhere between a couple of days to a couple of weeks. Swing traders are concerned with stocks that are bought and sold frequently. These stocks tend to oscillate between a very general high and a low extreme. When these stocks are at the low end of their value, stock traders buy them and sell them when their prices rise again.

3) Value investing

In stock trading, value investing is a strategy used by stock traders to buy shares that have huge potential to increase in value over time. These shares are mainly company stocks that are initially under-priced. Once it reaches its maximum value, the stock traders sell them off for a huge profit.

4) Growth investing

Growth investing is yet another way of earning profits in the field of stock trading. When companies bear indications of a healthy growth rate, their shares are bought by stock traders. As opposed to value investors, growth investors buy shares that are on the expensive side. However, according to their calculations, these shares are the ones that will go on to be worth a lot more than what they paid for it. The faster the company grows, the quicker the value of the stock rises.

Stock trading is a roller coaster ride. Traders need to be on the alert at all times to have any hope of making it big in the share market. They need to be opportunists to be successful here. It all boils down to perfect timing and a little bit of luck.